by Colin Moor, CAIB | Jul 12, 2011 | Research Centre

Imagine your home is damaged. You call your insurance agent to report the claim. And then you hear the worst news possible, “I’m sorry. That’s not covered by your policy.”

Now, you have a real problem.

The unfortunate truth is no insurance policy covers you for everything that could possibly happen to you or your property. However, with a little bit of understanding you can make sure you have the protection you want … and make sure your claims get paid by the insurance company.

Beware: It’s Not Always Covered

Just because you have an insurance policy that doesn’t mean your home is covered for everything.

Your home policy doesn’t cover you against every “cause of loss”.

What’s that?

Fire is a cause of loss. High wind is a cause of loss. These are also known as “perils” in insurance terminology.

A standard home policy excludes many causes of loss. That is, it does NOT protect you from certain perils – like earthquake, flood and surface water, termite damage and many more. That means if your home is damaged by one of these excluded perils your policy will not respond. You have no insurance against them.

If you want insurance against some of these perils, you can buy it … like earthquake or flood insurance. However, some excluded perils are not insurable … like insect damage. Be sure to discuss your policy exclusions with a broker in our office and buy the protection you really need. Don’t be caught by surprise after the damage is done. It’s too late to buy insurance then.

Special Limits On Personal Property

As if your home policy wasn’t complicated enough already it includes “special limits” of protection for some of your personal property. A “special limit” reduces the protection specifically available for certain types of property.

Property subject to a special limit typically includes … property used for business … cash & coin collections … jewelry & furs … guns … silverware … and more.

Additionally, some of these special limits apply only if the property is lost or stolen – making things just a little more confusing.

For example, the standard home policy typically includes only $1,000 of protection for stolen jewelry. If your $2,500 diamond engagement ring is stolen you’ll get only $1,000 from the insurance company. Ouch! And, if the stone falls out of the ring and is lost, there may be NO coverage at all!

The bottom line is it’s very important you fully discuss these conditions and special limits with your broker and buy the protection you need. Otherwise, you could find yourself with a very nasty surprise … an unpaid claim!

Conducting Business At Home

WARNING! Your home policy has very strict limits and rules about business conducted at home. The protection offered by your policy is severely limited if your claim arises from business activities. Your business property has very little coverage. And in some cases you may have no liability protection at all.

This is not something to take lightly and just assume everything will be fine. Be sure to discuss your home business activities with a licensed broker in our office to make sure you’re still protected.

Other Exclusions and Options

The standard home policy excludes protection for many things. But then the insurance company gives you an opportunity to buy some of them back.

Additionally, you have the option of increasing protection where you personally need it.

There are literally dozens of optional coverages available in your home policy. Here are some of the more common options available to you:

Identity Theft – many home insurers now offer protection for Identity Theft in their home policies. This will help pay the expenses you incur to restore your identity if it’s stolen.

Water & Sewage Backup – the standard home policy excludes damage caused by a water or sewage system backup. You can buy this protection if you want it.

Ordinance & Law –– pays the increased costs of repairing or rebuilding your home that are a result of changes in local building codes. For example, your home has single paned windows. After a loss, the local building department requires double-paned windows. This endorsement pays for the increased cost required by the new building code or bylaw.

Packaged Endorsements – often times an insurance company will package the optional coverages people most commonly buy into a single endorsement. That means for a lower price you can get several optional coverages added to your policy.

There are many more optional coverage and exclusion buy-backs your broker can explain to you. Take a few moments to understand them and make good decisions about your protection.

by Colin Moor, CAIB | Jul 12, 2011 | Research Centre

While it may seem complex, insurance is really quite simple: The payments (or premiums) of the many pay for the losses of a few.

Your premiums go into a large pool, if you will, at your insurance company. The claims of the few are paid from that pool. Because there are more people contributing to the pool than there are making claims, there is always enough to pay the claims – even large single claims like when someone is permanently disabled as a result of a car collision, or many smaller claims like those resulting from a natural disaster. (The 1998 ice storm that hit parts of Ontario, Quebec and New Brunswick resulted in an estimated 700,000 claims for damage totalling $1.4 billion.) However, large disasters (such as the ice storm) do come close to emptying the pool.

Insurance for insurance companies

Even when the pool comes close to emptying, there is another pool from which insurance companies can draw to pay claims. Some of your premiums are used by your insurance company to buy reinsurance – insurance for insurance companies.

Sometimes losses are so big – like those resulting from an earthquake – that there is no way that an insurance company can cover the costs. Reinsurance is an extra layer of protection against large losses.

Annual replenishing

Your insurance is an annual contract, so the pool operates for only one year at a time.

Your premiums and the premiums of others are based on how much money the insurance companies think they will need to pay the coming year’s claims. Your premiums do not build up over the years – unlike the premiums for some types of life insurance.

How premiums are calculated

Within reasonable limits, some of which are prescribed by law, your premium is calculated to reflect the probability that you will make a claim – that is, that you will draw funds from the insurance pool. Those who are unlikely to draw from the pool pay less than those who are more likely to draw from it.

Insurers take many factors into consideration to determine the likelihood that you will make a claim. A common misconception is that a policyholder who has never made a claim should pay less, little or nothing for insurance. While it is true that past claims history is important, a more reliable indicator of how likely a person or business is to make a claim is the statistical group to which he/she/it belongs.

Industry earnings

Insurance companies generally do not make money on the premiums gathered from policyholders.

In 2005, insurance companies paid more than $21 billion in claims while taking in $35 billion in premiums. The difference between the premiums and claims, in this case $14 billion, is used by the companies to pay salaries and taxes ($6.2 billion in 2005), and to cover the overhead costs (such as electricity bills) of running a business. It is also used to pay the administrative costs of settling a claim.

Insurance pays for …

Insurance pays for only those types of losses described in your contract. It is very important that you read your policy and/or talk to your insurance broker about what you are covered for and what you’re not.

Insurance will not pay for every problem that you may encounter, nor is it a maintenance contract.

Insurance is generally intended – and priced accordingly – to help policyholders cope with the financial consequences of unpredictable events that are “sudden and accidental.”

If, for example, you live on a floodplain by a river, flooding of your property in the spring is not sudden or accidental; it is inevitable and, therefore, uninsurable.

Source: Insurance Bureau of Canada

by Colin Moor, CAIB | Oct 11, 2010 | Research Centre

What you need to know about changes to auto insurance in Ontario

The Ontario government has introduced significant reforms to the auto insurance system in order to provide you, the consumer, more choice over the coverages and price you pay for insurance.

These additional accident benefit choices will allow you to customize your policy to suit your needs.

The goal of these changes is to achieve rate stabilization by keeping the costs incurred by the insurance companies in check with emphasis placed on Accident Benefits coverage.

Without these reforms, major rate increases would be required.

Standard Auto Insurance Policy

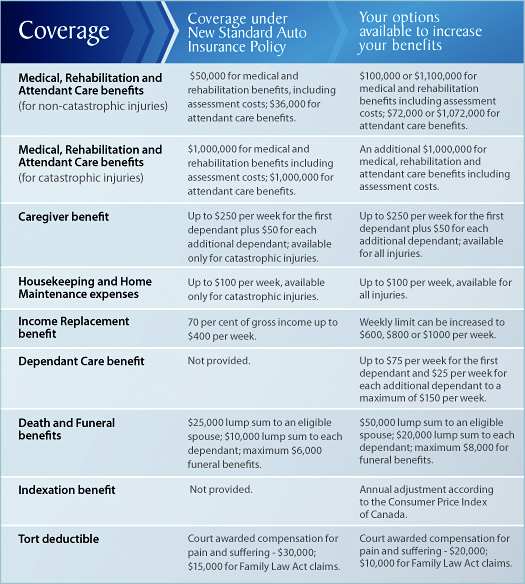

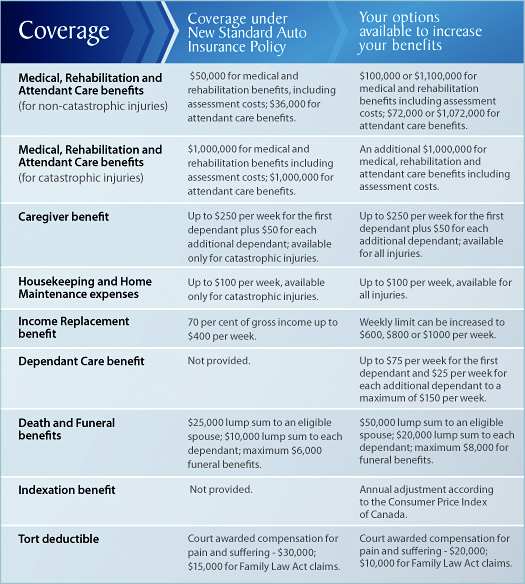

In Ontario, the Insurance Act determines the standard coverage that consumers must purchase. As a result of the reforms, some of the features under the Standard Auto Insurance Policy have changed.

Since September 1, 2010, if you are either buying a new auto insurance policy or renewing an existing one, you have more options to purchase a level of coverage that is right for you.

All auto insurance policies will continue to include the following:

Ø Third-Party Liability

Ø Uninsured Auto coverage

Ø Direct Compensation-Property Damage

Ø Statutory Accident Benefits

In addition, if you previously purchased Collision and/or Comprehensive coverage, it will still be included in your policy.

After September 1, 2010, when you are buying a new policy or renewing an existing one, you have the following options with respect to Statutory Accident Benefits:*

Ø Direct Compensation – Property Damage Coverage – You have the option of a $500, $300 or no deductible at all on coverage to repair the auto of the driver who is not-at-fault.

What else is new?

The government’s reforms lay the foundation for an auto insurance system with greater price stability, and more protection for you, theconsumer.

Other key changes include:

Ø Many injuries received in an auto accident are minor. If you have a minor injury due to an auto accident, your medical and rehabilitation accident benefits are limited to $3,500 regardless of the coverage level you have selected.

Ø Accidents where you are 25 per cent or less at-fault will no longer affect your premium.

Ø The deductible that is applied to court awards for fatal accidents has been eliminated.

Ø A new requirement that insurance companies send out benefit statements to their claimants, advising how much has been paid to date, and the additional amounts remaining for medical, rehabilitation and attendant care benefits.

Ø If your auto has been damaged or written off after an accident and you don’t agree with the value you have been offered or your degree of fault for the accident, you can choose the appraisal process outlined in the Ontario Auto Policy to settle the dispute, and the insurer must agree to participate.

Ø Coverage is extended to rented autos with a Gross Vehicle Weight Rating (GVWR) of more than 4,500 kilograms, if for personal use and rented for up to 7 days.

Ø Prohibiting use of credit scores in giving quotations for your auto insurance rates.