by Eddie Rodriguez, CAIB | Jul 11, 2011 | Research Centre

In Ontario, auto insurance is mandatory. But the government doesn’t require you to buy ‘Accident Benefit upgrades ‘ or the so-called ‘full coverage’. You are only required to buy the minimum liability coverage*. This is so you can pay for some of the damage your car does to other people or other people’s property..

* In this other article, I’ll point out OTHER ‘insurance coverages‘ that are also mandatory in Ontario.

How much are you required to buy? In Ontario, the minimum liability amount is $200,000. That’s not much. In fact, it’s next to nothing.

* Tip. The minimum amount of insurance required in Ontario is NOT much. Seriously consider getting more coverage ($2,000,000.00 or more) in order to protect your financial health.

* Note. Notice that mandatory auto insurance laws in Ontario do not require you to buy certain coverages for your own car. It’s up to you to decide if you want to buy protection against such risks as vandalism, fire, theft and damage to your car in case of an “at-fault” collision.

If you buy just the minimum coverage required by law, you are leaving your assets at considerable risk. Your car, obviously. And your home, if you are at fault in an accident that causes serious injuries to the other parties.

How far do you think the minimum $200,000 will go if you hurt somebody and they can’t work for 5 years?

Not far enough!

by Eddie Rodriguez, CAIB | Jul 11, 2011 | Research Centre

There are several ways you can purchase auto insurance. You can buy it over the Internet at literally hundreds of different web sites. You can call an 800 number and buy it over the phone directly from an auto insurance company. You can call an insurance agent or an insurance broker. In some cases, you can buy from a bank or credit union.

It’s not surprising you can buy it in so many ways. After all, there are hundreds of insurance companies that sell auto coverage in your area.

How do these companies differentiate themselves? Some brag about their superior service when you have a claim. Some tout how easy it is to buy from them. And, often, auto insurance companies try to compete on price, just as if you were buying a plane ticket, a CD or a pop.

* Tip. Some people believe auto insurance is just a commodity. It’s not.

You’re not buying a soft drink. You’re protecting your financial well being … and the choices you make could affect you for the rest of your life.

If you think auto insurance is a commodity, consider this:

A person with a good driving record will pay three, five, even 10 times less than a driver with a couple of tickets, an accident or who has been cited for and convicted of driving under the influence.

A person who lives in a major city – say Toronto or Brampton- will pay three, four, even five times more than someone who lives in a rural area or small town, even though the two have the same driving records.

–

by Colin Moor, CAIB | Oct 11, 2010 | Research Centre

What you need to know about changes to auto insurance in Ontario

The Ontario government has introduced significant reforms to the auto insurance system in order to provide you, the consumer, more choice over the coverages and price you pay for insurance.

These additional accident benefit choices will allow you to customize your policy to suit your needs.

The goal of these changes is to achieve rate stabilization by keeping the costs incurred by the insurance companies in check with emphasis placed on Accident Benefits coverage.

Without these reforms, major rate increases would be required.

Standard Auto Insurance Policy

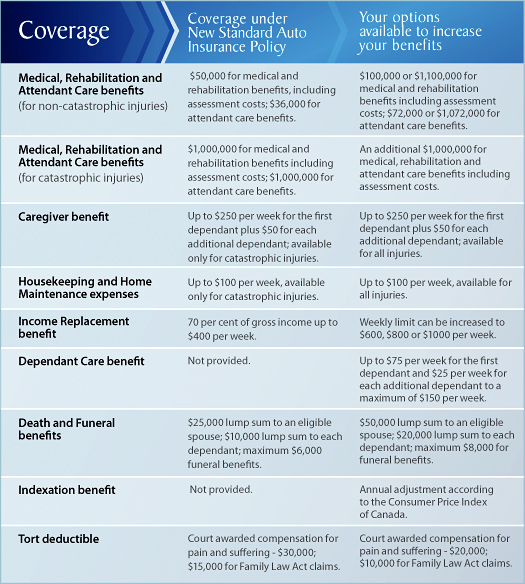

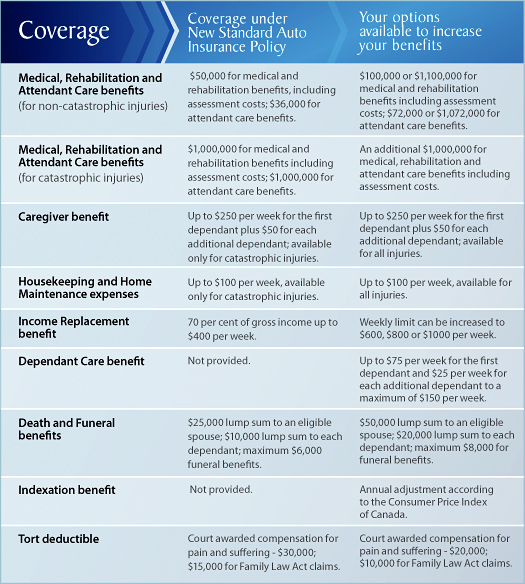

In Ontario, the Insurance Act determines the standard coverage that consumers must purchase. As a result of the reforms, some of the features under the Standard Auto Insurance Policy have changed.

Since September 1, 2010, if you are either buying a new auto insurance policy or renewing an existing one, you have more options to purchase a level of coverage that is right for you.

All auto insurance policies will continue to include the following:

Ø Third-Party Liability

Ø Uninsured Auto coverage

Ø Direct Compensation-Property Damage

Ø Statutory Accident Benefits

In addition, if you previously purchased Collision and/or Comprehensive coverage, it will still be included in your policy.

After September 1, 2010, when you are buying a new policy or renewing an existing one, you have the following options with respect to Statutory Accident Benefits:*

Ø Direct Compensation – Property Damage Coverage – You have the option of a $500, $300 or no deductible at all on coverage to repair the auto of the driver who is not-at-fault.

What else is new?

The government’s reforms lay the foundation for an auto insurance system with greater price stability, and more protection for you, theconsumer.

Other key changes include:

Ø Many injuries received in an auto accident are minor. If you have a minor injury due to an auto accident, your medical and rehabilitation accident benefits are limited to $3,500 regardless of the coverage level you have selected.

Ø Accidents where you are 25 per cent or less at-fault will no longer affect your premium.

Ø The deductible that is applied to court awards for fatal accidents has been eliminated.

Ø A new requirement that insurance companies send out benefit statements to their claimants, advising how much has been paid to date, and the additional amounts remaining for medical, rehabilitation and attendant care benefits.

Ø If your auto has been damaged or written off after an accident and you don’t agree with the value you have been offered or your degree of fault for the accident, you can choose the appraisal process outlined in the Ontario Auto Policy to settle the dispute, and the insurer must agree to participate.

Ø Coverage is extended to rented autos with a Gross Vehicle Weight Rating (GVWR) of more than 4,500 kilograms, if for personal use and rented for up to 7 days.

Ø Prohibiting use of credit scores in giving quotations for your auto insurance rates.