My Driving Discount™: The Smart Road to Savings!

We’re pleased to announce the launch of the my Driving Discount™ program: the smart road to savings!

Some people have better driving habits than others. The program rewards good driving behaviour.

The my Driving Discount™ program is available exclusively to clients insured through Intact Insurance.

With my Driving Discount™ , you could save up to 25%* off your car insurance premium. Enrolling is quick and easy and you’ll automatically get a 5% … 10% discount when you sign up.

How Does it Work?

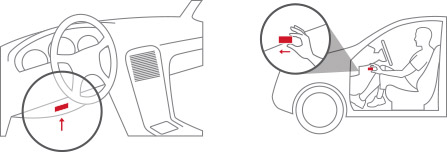

Contact us online or call our office at 416-255-3728 to sign up. Once enrolled, you will receive your device in the mail.

Simply plug this into your car and it will record your driving behaviour including:

- braking,

- acceleration

- and time of day you drive.

The reported data is used to calculate a personalized discount of up to 25% off your car insurance premium. Once you complete your initial assessment period (minimum of 180 days) your earned discount will be applied to your policy at your next renewal. But that’s not all ….

You’ll also be able to view your driving data and your potential discount on your own personalized website.

Key Benefits:

- Save immediately! Get a 5% … 10% enrollment discount just for signing up

- Earn up to 25% discount at renewal (minimum of 180 days monitoring required)

- Customized car insurance premium that reflects the way you drive

- Nothing to lose, your premium won’t increase based on the data collected

- Personalized website that shows your driving behaviour and discounts

- Small, easy to install device

The my Driving Discount™ program is available exclusively to clients insured through Intact Insurance.

Frequently Asked Questions

1. What factors are taken into consideration when calculating my potential discount?

my Driving Discount™ could reward you with a personalized discount by assessing the time of day that you drive, along with your acceleration and braking, based on the kilometres driven.

![]() Hard Braking: Hard braking increases the risk of being involved in an accident. The program therefore calculates the ratio of hard braking events on total km driven to determine your personalized hard braking factor. A hard braking event is defined as any decrease of speed of 12 km/h or more in less than 1 second.

Hard Braking: Hard braking increases the risk of being involved in an accident. The program therefore calculates the ratio of hard braking events on total km driven to determine your personalized hard braking factor. A hard braking event is defined as any decrease of speed of 12 km/h or more in less than 1 second.

![]() Rapid Accelerating: Rapid accelerations increase the risk of being involved in an accident. The program therefore calculates the ratio of rapid acceleration events on total km driven to determine your personalized rapid acceleration factor. A rapid acceleration is defined as any increase of speed of 12 km/h or more in less than 1 second.

Rapid Accelerating: Rapid accelerations increase the risk of being involved in an accident. The program therefore calculates the ratio of rapid acceleration events on total km driven to determine your personalized rapid acceleration factor. A rapid acceleration is defined as any increase of speed of 12 km/h or more in less than 1 second.

![]() Time of day: Driving at night (between 12 a.m. and 4 a.m.) increases the risk of being involved in an accident. Many elements, such as reduced visibility and fatigue, make this time of day the riskiest. The program therefore evaluates the time of day that you’re driving to determine your personalized high-risk period factor. The less you drive at night the more you could save.

Time of day: Driving at night (between 12 a.m. and 4 a.m.) increases the risk of being involved in an accident. Many elements, such as reduced visibility and fatigue, make this time of day the riskiest. The program therefore evaluates the time of day that you’re driving to determine your personalized high-risk period factor. The less you drive at night the more you could save.

2. When will I receive my personalized discount?

If you are eligible for a personalized discount, your premium will be adjusted at renewal upon the completion of your assessment period.

3. How long is my assessment period?

Your initial assessment period is for a minimum of 180 days from when you install your device and start driving.

If the assessment period cannot be completed prior to when your renewal is issued (not the effective date of the renewal) , then the renewal will be issued with your 5% enrollment discount. The personalized discount will be applied upon the subsequent renewal.

4. How long will my personalized discount apply?

Your personalized discount is not static and is subject to change upon each successive renewal of your policy. All successive discounts will be calculated based on the previous 12 months of data collected to assess your driving habits.

5. If I have to brake hard to avoid an accident, will that reduce my discount?

We look for the frequency of events and regular driving behaviours. We know that even the best drivers have to brake hard occasionally. So it doesn’t necessarily mean that if you brake hard once, your discount will be reduced.

The most important thing is your safety. If you need to hard brake to avoid an accident, make sure you do!

6. Can my premium go up because of my driving habits?

No, your premium will not increase as a result of the data used to calculate your discount (time of day you drive, braking, and acceleration). For complete details on how your data is used, please refer to the Terms of Use.

7. What happens if I have an accident while using the my Driving Discount device?

Accidents are not taken into consideration when calculating your potential personalized discount.

However, this may nevertheless have an impact on your insurance premium as per our standard practices If you have questions about your policy or premium, please contact us.

8. How is my driving data used?

The collected driving data will be used to determine your eligibility and potential discount following your assessment period.

We may also analyze the collected driving data to ensure consistency with your policy, and you may be contacted by your broker to see if you wish to discuss your policy further.

9. Can I change my mind and opt out of the program? If so, will my insurance policy be cancelled?

Yes. You may opt out at any time.

Your insurance policy will NOT be cancelled even if you opt out of my Driving Discount program. The program is optional. Please contact us if you have any questions.

10. Can multiple principal drivers on the same policy enrol in the my Driving Discount program?

Yes. Every principal driver on the policy can enrol if they meet the eligibility criteria.

Sign Up for my Driving Discount™ and start saving today

TM my Driving Discount is a trademark of Intact Insurance Company. © 2014, Intact Insurance Company. All rights reserved.